All about IOB Net Banking

Internet Banking is an electronic payment system that let its account holders perform a variety of financial transactions through the bank’s website. Earlier, customers were required to visit banks for each and every service that banks used to offer. Still, after the introduction of IOB Net banking, customers are at ease as almost all the services can be easily accessed sitting at home and that too round the clock.

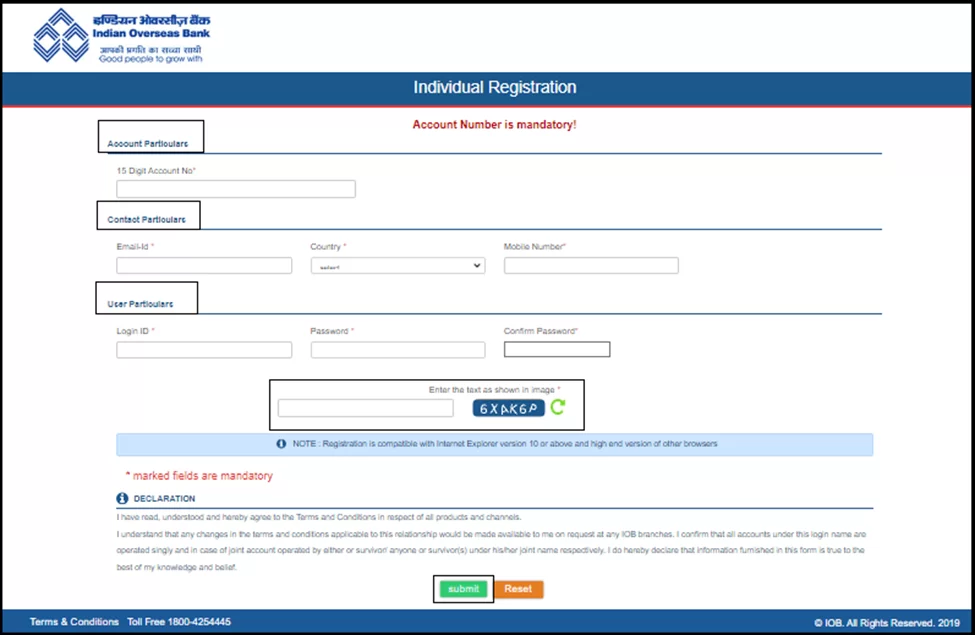

Steps To Register For IOB Net Banking

Step 1: Open the official website of Indian Overseas Bank at https://www.iobnet.co.in. and then click the “Register” option provided below the “Personal Login” tab.

Step 2: Then, the customer is required to provide all his basic information like Account number, Email ID, Country Name, and mobile number to register for IOB Net banking.

Step 3: On successful validation, the customer is given an option of self-activation from the branch, from which he can select any one.

Step 4: To register for IOB Net Banking in case the customer opts for self-activation, enter the following details:

a Debit Card Number

b Expiry Card of the Debit Card

c Debit Card PIN

Step 5: And if the customer selects activation through the branch then an OTP will be sent to his/her registered mobile number. Upon the successful verification of OTP download the form and fill in the required information.

Step 6: On submitting the above details and successful verification Internet Banking will be approved without Fund transfer.

Step 7: If debit card validation fails then the customer is required to go through the registration process again.

Step 8: On successful validation, the customer login id will be activated.

Services Offered by IOB net banking :

- Balance Enquiry- IOB Net Banking lets an account holder view the account balance using the login id and password.

Also, the account holders can place a miss call to the IOB balance check number through their registered mobile number. IOB Bank account holders can do IOB Balance Enquiry using missed call banking by following the below-mentioned steps –

-

- Call IOB Balance Check Number i.e. 9289 922 2029 from the mobile number registered with the bank

- The call will automatically disconnect after two to three rings

- Lastly, the account holder will receive the IOB Bank Account Balance via SMS on the registered mobile phone.

- Transaction History– It allows customers to have access to the last few transactions of their accounts using internet banking.

Go to the tab “Accounts”, then to “Last few transactions”, so as to access the transaction details.

- Account Statement – With the help of IOB Net Banking customers can easily access their Account Statement.

- Cheque Book Request

IOB Net Banking allows its customers to place the request for the issuance of Cheque book with the help of internet banking.

Go to the tab “Accounts” and then click on “ Cheque Book Request” .

Select the account for which cheque book is required and further click on “Submit”.

- Check the Cheque Paid Status

After logging in, go to the Accounts section and then select “cheque paid”. Further, select the account type, date, and cheque number to get the status of the cheque.

- Access Civil Pension Account

With the help of IOB Net Banking, ex-civil servicemen can get access to their civil pension accounts.

After successful login, click on “Accounts” and then on “Civil Pension view” to have access to payslips etc.

- Loans / Deposits

One can get the details of the loans or deposits made with the help of internet banking as well.

Go to “Accounts” and then click on View Loans/ Deposits section.

- Funds Transfer Services

IOB Net banking allows its customers to transfer funds quickly in very less time sitting at home. Customers can transfer their funds from either personal accounts or from their corporate accounts as well.

Also, it allows to make remittances as well.

- Utility payments

Customers can easily make tax payments be they direct or indirect taxes.

Also, it allows to make payments like donations, mobile/ TV recharges, book movie tickets, pay Electricity/Water/Gas bills, Insurance premiums etc.

Features of IOB Net Banking

Below mentioned are the salient features of IOB net banking:

- Provides a secure and convenient method of banking

- Provides a password-protected banking service

- To have easy access to financial and non-financial banking services

- To access to the bank account anytime and from anywhere

- To track and manage bank balance, last transactions, statements, etc.

- To transfer funds online via NEFT, RTGS, or IMPS anytime

- To process bill payments in a faster manner.

- To keep track of payments, personal loans, home loans, business loans, credit cards, savings accounts, etc.

- To channelize or cancel automatic payments

Questions to Ask

What is the login process for IOB Net Banking?

Below mentioned are the steps to make login for IOB net banking.

Step 1: Login using the Customer ID and password.

Step 2 The login password and transaction PIN are different from each other. Passwords are used to log in and transaction PIN for funds transfer.

Step 3: Customers are required to remember the passwords as the online account can be blocked for putting consecutively wrong passwords.

How can an account holder get an IOB Account statement?

Below mentioned are the steps to view the IOB Account statement:

- Go to the Accounts section and then click on Account Statements. Further, click on the option View/ Print.

- Select the period for which the statement is required i.e. “From date” and “To date” and then click “Submit”.

- Also, to save the account statement, click on export.

Who can register for Indian Overseas Bank Net Banking

- Savings/ Current account holders

- Deposit / Loan account holders

- Proprietary firms

- Partnership companies

- Limited Companies

- Societies/Trusts

- HUFs

What if a customer forgets the IOB net banking password?

Below mentioned are the steps to reset the IOB net banking password:

- Open the official website of IOB.

- Click on ‘Forgot Password”.

- Enter the Login ID, account number, email ID and captcha.

- Click on “Continue” to reset the password.