If there is an agreement between the broker and the investor because of the current market situation, they need to repeat the same, when its position is closed, then at that time, the settlement of the difference between them is done. When it comes to CFD trading, it has many advantages that are currently being used by investors and all those that are not yet present in direct trading, such as leveraged trading, access to foreign markets, and trading of assets. Traditionally for short positions, the option is not offered.

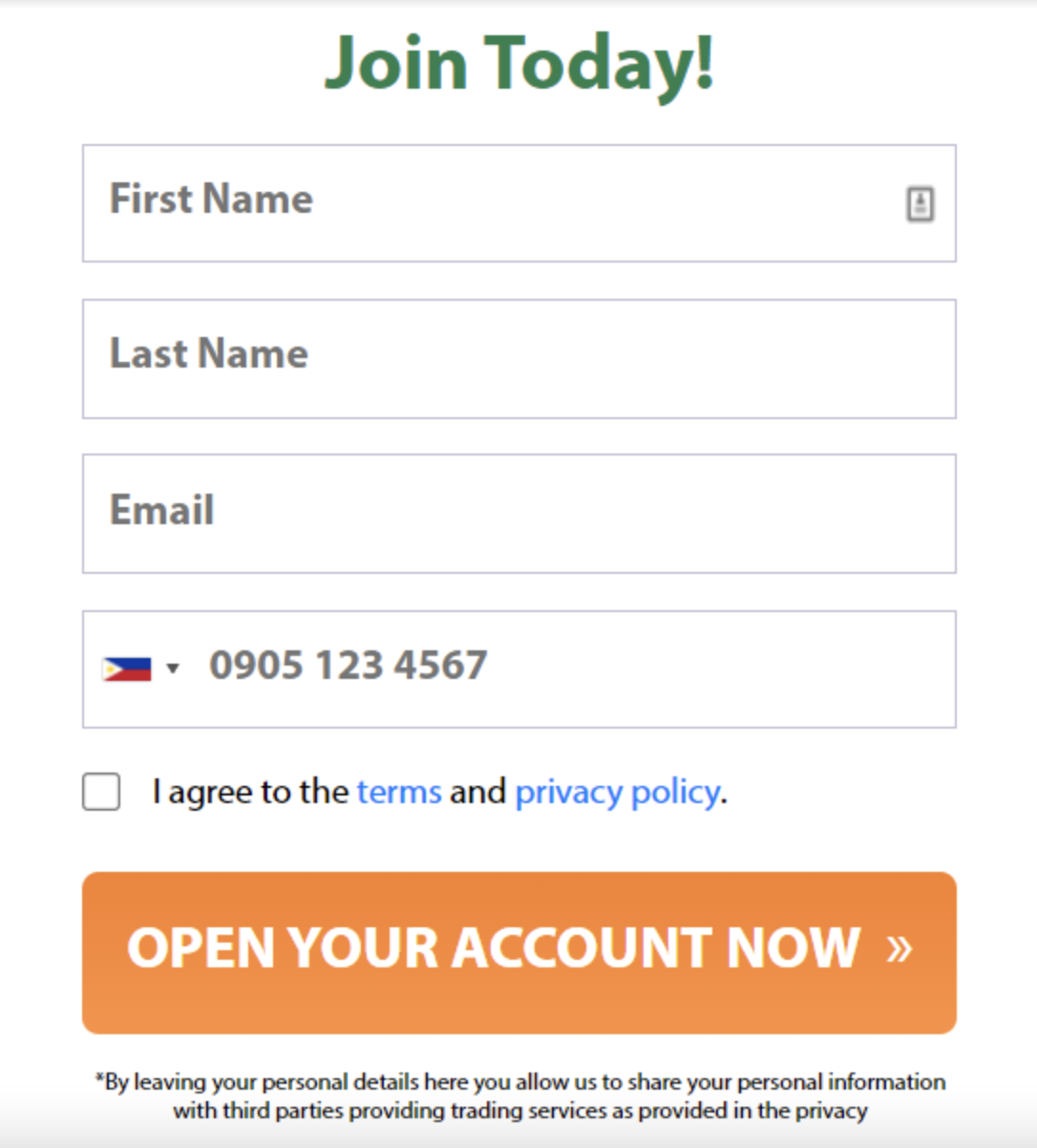

Click this image below to start bitcoin trading.

How do traditional CFDs work?

This article follows some of the working mechanisms as well as some logic from CFDs:

The asset is selected by the trader in the form of CFDs. This can include an index, stock, currency or another asset that is selected in front of the broker. Trader positions are opened when they are opened or are set by parameters just like whether its long or short positions are exposed, amount invested, leverage and other parameters.

The two participate in a contract, concurring on what the initial cost for the position is, and whether extra charges are involved. The position is opened and stays open until either the trader chooses to close it or it is shut by a programmed order, for example, arriving at a Stop Misfortune or Take Benefit point or the lapse of the contract. On the off chance that the position shuts in benefit, the agent pays the trader. If closes a loss, the merchant charges the trader for the distinction. Even though it appears thus, there is at some point disarray among CFDs and ETFs, which are unique financial items.

What is CFD Trading in Crypto?

Digital currencies as alternative investments or CFDs have created a lot of interest among people. A large part of the bitcoin currency has seen a huge jump, which is why it is in the headlines today. In the year 2017, the price of bitcoin reached $19,000 at the end of the year. When people saw the increase in its prices, it started attracting the attention of all the traders.

Futures contracts with bitcoin have been introduced through the CBOE and CME exchanges, giving some of the new asset space credibility. It has flooded the market through crypto CFD trading. Many people put their money in cryptocurrencies and they come in contact with them, with which there are many drawbacks associated with them. The processing time for buying crypto is very slow as it reflects the trading of forex. At the same time, it is unregulated with many other wallets compromising on it, some of which have their own horror stories.

The distinction among a ETF and an CFD

When it comes to the similarities among FTFs and CFDs, both are different, with the main similarity being that both CFDs and ETFs are derivatives. Here we are talking about an ETF which is a fund it combines various instruments to trade with financial assets. A CFD is a contract to change the value of another asset, i.e. in both these cases, one cannot buy the underlying asset. Nonetheless, while ETFs are made by financial organizations following a particular market strategy a CFD is presented by a specialist to empower admittance to private clients.

Like ETFs, CFD trading can be utilized to fabricate a portfolio that follows a market strategy, giving the client unlimited oversight over the resources they pick, and empowering them to deal with their hazard. Along these lines, users and crypto fans have high expectations for Bakkt and other ETF transactions.